- 50 30 20 BUDGET SPREADSHEET HOW TO

- 50 30 20 BUDGET SPREADSHEET DOWNLOAD

- 50 30 20 BUDGET SPREADSHEET FREE

If you just want the download and don’t want to wait until the end – you can grab your 50/30/20 spreadsheet below.

50 30 20 BUDGET SPREADSHEET FREE

Download the FREE 50/30/20 Budget Template and Calculator.

50 30 20 BUDGET SPREADSHEET HOW TO

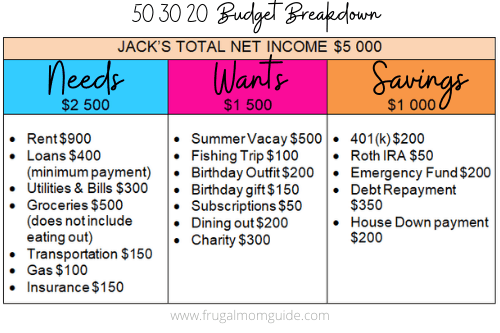

With a clear understanding of your income and expenses, you can make informed decisions about how to spend your money and achieve your financial goals. This can help you build an emergency fund, save for big-ticket items like a down payment on a house or a new car, or invest for your long-term financial future.īy adopting the 50-30-20 rule early on, you can establish good financial habits and manage your money more effectively. Regardless of your personal ratios, it’s important to always allocate at least 20% of your income to savings. On the other hand, if you have a comfortable emergency fund and no debt, you may be able to allocate more than 30% to wants. Once you’ve mastered the 50-30-20 rule, you can begin to adjust the ratios to better suit your individual financial situation and goals.įor example, if you have a lot of debt, you may want to allocate more than 20% to savings and debt repayment. If you’re looking for a simple and effective way to manage your finances, the 50-30-20 rule is a great starting point.īy allocating 50% of your income to needs, 30% to wants, and 20% to savings, you can create a budget that covers your basic expenses, allows you to enjoy your life, and helps you save for the future. This balance can help you achieve financial stability and peace of mind. By allocating 50% of your income to needs, 30% to wants, and 20% to savings/debt repayment, you can ensure that you’re covering your basic expenses, enjoying your life, and saving for the future. The 50/30/20 rule helps you strike a balance between your income, expenses, lifestyle, and necessities. The 50-30-20 rule of budgeting strikes the right cord of balance between income, expenses, lifestyle and necessities This can help you avoid overspending and living beyond your means, which can lead to financial stress and debt. The 50-30-20 rule of budgeting will give you a better understanding of what you can affordīy setting a budget using the 50/30/20 rule, you will have a better understanding of what you can afford and where you need to cut back. Similarly, if you have a high income, you may be able to allocate more than 30% of your income to wants. For example, if you have a lot of debt, you may want to allocate more than 20% of your income to debt repayment. You can adjust the percentages to suit your individual financial situation and goals. The 50/30/20 rule is a customizable and flexible budgeting option. Organize the finances as per your requirements and availability of funds By categorizing your expenses, you can also identify areas where you may be overspending and make adjustments accordingly. This makes it clear what your financial priorities are and helps you stay focused on your goals. The 50/30/20 rule helps you categorize your expenses into needs, wants, and savings/debt repayment. Categorize and be clear about what needs to be done This can save you time and energy in the long run, as you won’t have to constantly track your spending or worry about overspending. The 50-30-20 rule of budgeting saves time & energyīy setting a budget using the 50/30/20 rule, you can quickly and easily categorize your income and expenses, making it easier to see where your money is going and how much you have left to spend. Remember, the goal of budgeting is not to restrict your spending, but to help you make the most of your money and achieve your financial goals. Be flexible and willing to make changes as needed to ensure you’re staying on track with your financial goals. As your income and expenses change over time, you may need to adjust your budget accordingly. Make adjustments if requiredĬreating a budget is an ongoing process. If your expenses exceed your income, you may need to adjust your spending or find ways to increase your income. Take a look at your expenses and determine how much you need to allocate to each category. The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Evaluate the amount that can be spaced out in every category This will help you prioritize your spending and make sure you’re not overspending on things you don’t really need. rent, food, utilities) and which are discretionary (e.g. Once you have a list of your monthly expenses, identify which expenses are necessary (e.g. Use this information to create a detailed list of your monthly expenses. Keep track of all your expenses for a month, including fixed expenses like rent and utilities, as well as variable expenses like groceries and entertainment. To create an effective budget, you need to know where your money is going.

0 kommentar(er)

0 kommentar(er)