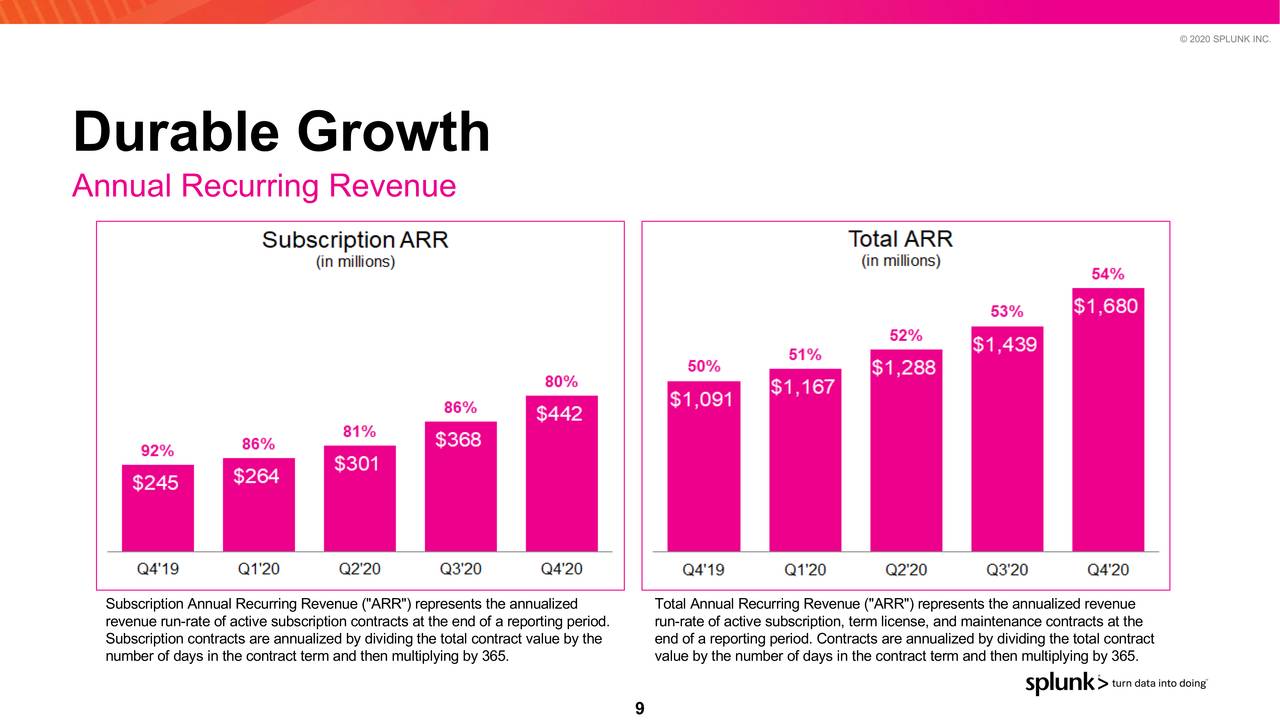

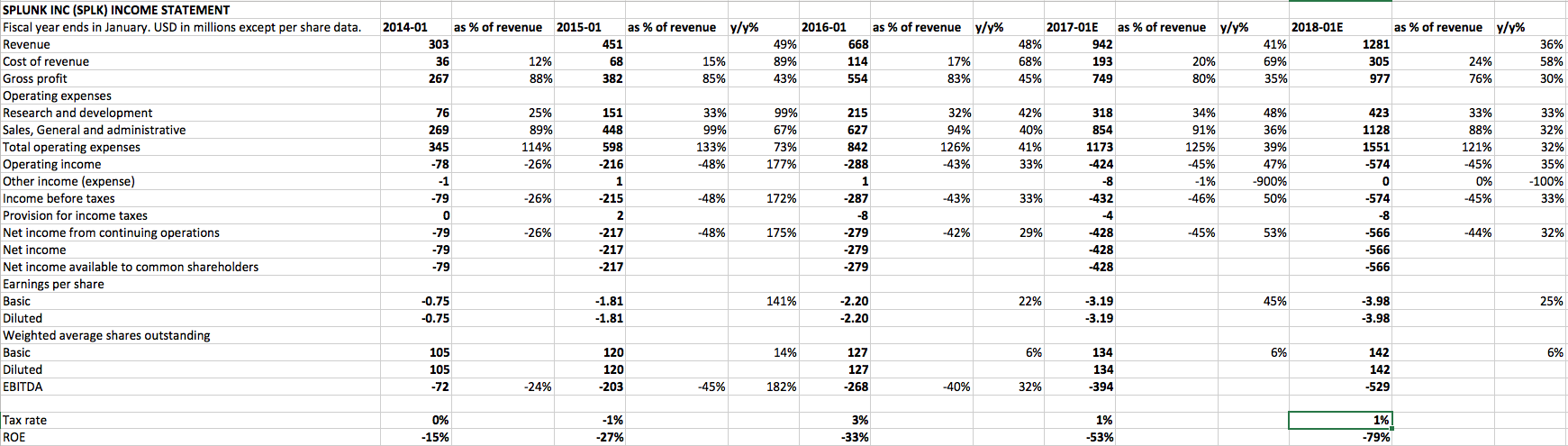

However, even with so much seemingly strong double digit growth at play, Newman said, ‘EPS is still negative, indicating significant resources being invested in growth, and being slightly worse than estimates, the street was hard on the stock after earnings.” He continued, “Having said that, I believe the company is in the middle of an important pivot and while negative EPS isn’t ideal, shifting to Splunk Cloud, and making the necessary investments to accomplish this is the appropriate course of action at the current juncture.” Total revenues were $502 million, up 16% year-over-year.Ģ03 customers with Cloud ARR greater than $1 million, up 99% year-over-year.ĥ37 customers with Total ARR greater than $1 million, up 46% year-over-year. Total ARR was $2.47 billion, up 39% year-over-year.Ĭloud revenue was $194 million, up 73% year-over-year. In his piece, Newman highlighted Splunk’s Q1 results by listing these impressive metrics:Ĭloud ARR was $877 million, up 83% year-over-year. As you can see below, there was a lot of growth to be seen, which has inspired the most recent leg-up in the stock from ~$115 to ~$140. It’s the speculation that still exists with regard to whether or not Splunk can return to profitability (in 2020, Splunk generated $1.88 in earnings-per-share however, in 2021, that figure is expected to go negative, with the consensus analyst estimate coming in at -$0.55/share) that is holding SPLK shares down at the moment.ĭaniel Newman, a Nobias 4-star rated analyst, recently published an article at, which highlighted Splunk’s recent Q1 results. However, he said the company still has work to do on the financial side of the transition.”

#SPLK SEEKING ALPHA SOFTWARE#

All of its software is now available in the cloud, on a subscription basis, he said. Wheatley wrote, “Merritt told Barron’s in an interview that from a technology point of view, the company has more or less completed its transition.

Today’s results show that the company is making good progress in that transition.” During his piece, Wheatley mentioned that Splunk’s Chief Executive Doug Merritt recently had an interview with Barron’s, which focused on this cloud-based transition. That has seen its revenue model change from one that’s based on perpetual licenses to cloud subscriptions, which provide a more predictable income stream.

With regard to this transition, Wheatley said, “The company has been steadily pushing its customers to cloud-based versions of its software. Where a lot of the recent weakness has come from in Splunk’s shares is the necessary transition from its slow-growth legacy software sales to a cloud-based software model which relies on the higher margin recurring sales that provide predictable earning’s results that Wall Street loves. Essentially, it provides easy access to enterprise’s operational data and delivers insights that can aid in business decision-making.” He said,“Splunk sells tools that are used by enterprises to monitor, search, analyze and visualize machine-generated data in real time. However, in a recent piece highlighting Splunk’s Q1 results which were posted in early June, Mike Wheatley, a 4-star rated Nobias analyst who writes for, described Splunk’s business model in more detail. When investors hear terms like “big data” or “the cloud” they’re oftentimes confused because of the ambiguity of these terms and the industries that they represent. With SPLK trading with an approximate 37.5% discount to its 52-week high, we wanted to dive into the recent research reports provided by the 4 and 5-star analysts that the Nobias algorithm tracks to see whether or not this is a dip that investors should consider buying. SPLK has popped a bit off of those lows throughout June and now sits at $141.24.

And yet, since then, SPLK has experienced a precipitous sell-off with shares hitting their new 52-week lows of just $110 in early May of 2021. The company traded down to below $100/share during the worst of the pandemic sell-off last March before rallying strongly to highs above $225/share during September of 2020. Coming into the pandemic, when tech stocks roared due to the belief that the secular growth associated with things like cloud expansion, SPLK shares benefitted. Splunk (SPLK) has been a bit of a head scratcher for investors over the last couple of years.

0 kommentar(er)

0 kommentar(er)